The Retirement Crisis: What Americans Believe

A wide range of polls show that the retirement crisis is all too real. Americans are experiencing the crisis firsthand, yet policymakers and opinion leaders are paying scant attention to the problem.

This summary provides results from a cross-cutting selection of polls to show the depth of national anxiety over retirement and the need to modernize our patchwork system of private pensions and 401(k)s.

Welcome to the Retirement Crisis

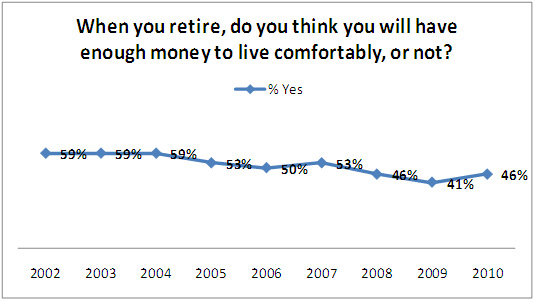

Americans are not confident they will have a comfortable retirement. Since 2002, Gallup has asked whether Americans believe they will have enough money when they retire to live comfortably. In 2010, less than half – 46% – say yes. Since the onset of the Great Recession, this has never passed 50%.[i]

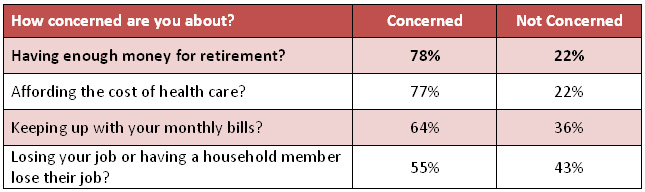

Americans are more worried about retirement than many other recession-induced hardships. In a poll by Benenson Strategy Group for the National Academy of Social Insurance, having enough for retirement was the most likely concern—surpassing anxiety over health care costs, paying monthly bills, or even job loss. An overwhelming 78% of Americans are concerned about having enough for retirement.[ii]

Many of those who do have retirement savings are raiding their accounts to get by. A significant minority of 44% have taken money out of a savings account, including retirement savings, to make ends meet.[iii] This jumps to a majority of 60% among the unemployed.[iv]

Even those who have investments are worried their value will continue to decline. A majority of 65% worry that the value of their stocks and retirement savings will drop.[v]

The problem is urgent: near-retirees are already planning to delay retirement. Pew Research Center asked non-retirees ages 50-61 – those closest to retirement – whether the recession might cause them to delay retirement: 60% said they may have to wait.[vi]

People are more afraid of outliving their money than they are of death. In a 2010 poll for Allianz Life Insurance, 92% of respondents say that there is a retirement crisis, and 61% said that they are more afraid of outliving their assets than they are of death.[vii]

Americans Can't Afford to Save for Retirement

Less than half of Americans set aside money for savings or investments. Only 46% say they put aside money for savings or investments.[viii]

A major problem is affordability: even before the recession, most Americans were not able to save more. A 2007 poll by Yankelovich, Inc., for the Rockefeller Foundation asked why non-savers were not setting aside anything for retirement. A majority of 56% said they could not afford to save more.[ix]

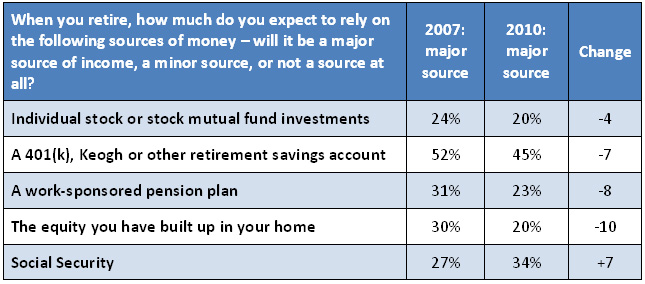

Fewer and fewer Americans feel they can rely on the existing patchwork of 401(k)s, IRAs and employer pensions. Over the last three years, anticipated reliance on the traditional private foundations of retirement savings has declined. In contrast, the expected need for Social Security has increased.[x]

The recession has only made the retirement crisis worse. According to the Center for Retirement Research, in 2004, 43% of American households were at risk of not having enough money in retirement. In 2009, the figure rose to 51%.[xi]

What Americans Want is Retirement Security

A secure retirement is a central part of the American Dream. When asked specifically whether a comfortable and secure retirement was part of the American dream, 85% said it was a major part and only 11% said it was a minor part.[xii]

Americans believe a secure retirement is an obligation. Eight in ten agree with the statement that “We have an obligation to provide a secure retirement to all working Americans.”[xiii]

A guaranteed retirement tops other job perks, such as healthcare and job security. When asked as part of the Yankelovich survey whether they would choose a guaranteed job for life, guaranteed health care for life, or a guaranteed pension in retirement, a plurality of 41% said they would choose a guaranteed pension in retirement.[xiv]

Conclusion

Retirement is clearly a “top-of-mind” issue among the general public. Americans believe that our patchwork system has not prepared them for retirement and that it does not provide the security they value. Washington should answer with real solutions that promise the stability and security that working Americans can count on.

[i] Abt SRBI for the Rockefeller Foundation/TIME. 2,008 adults nationwide, which includes an oversample of 502 African-Americans and 502 Hispanics. June 19-June 29, 2008. Margin of error: ±3 percentage points.

[ii] Benenson Strategy Group for the National Academy of Social Insurance. 1,488 adults nationwide, including 1,210 likely 2010 voters. July 7-14, 2009. Margin of error: ±2.25 percentage points.

[iii] Yankelovich, Inc., for the Rockefeller Foundation. 3,157 adults nationwide, with oversamples of African-Americans and Hispanics. February 6-19, 2007.

[iv] Center for Retirement Research. The National Retirement Risk Index: After The Crash, October 2009.

[v] Rasmussen Reports, LLC, for COUNTRY Financial Security Index. 3,000 Americans nationwide. June 2010. Margin of error: ±2 percentage points

[vi] Yankelovich, Inc., for the Rockefeller Foundation. 3,157 adults nationwide, of which 1,670 answered the question, “Which of the following are reasons you are not currently saving for retirement?” The survey included oversamples of African-Americans and Hispanics. February 6-19, 2007.

[vii] Allianz Survey 1,020 adults nationwide. April 8-11, 2010. Margin of error: ±4 percentage points.

[viii] CBS News Poll. 966 adults nationwide. July 9-July 12, 2010. Margin of error: ±3 percentage points.

[ix] CBS News Poll. 1,650 adults nationwide. December 4-10, 2009. Margin of error: ±3 percentage points.

[x] AP-GfK Poll. 1,002 adults nationwide. May 7-11, 2010. Margin of error: ±4.3 percentage points.

[xi] Pew Research Center Social and Demographic Trends Project. 2,697 adults nationwide. May 11-31, 2010. Margin of error: ±2.2 percentage points.

[xii] Larson Research and Strategy Consulting, Inc. and DSS Research for Allianz Life Insurance. 3,257 adults nationwide, aged 45-75, with “targeted subsamples of more affluent households and households who own annuities.” May 6-12, 2010. Margin of error: ±1.7 percentage points

[xiii] Benenson Strategy Group for the National Academy of Social Insurance. 1,488 adults nationwide, including 1,210 likely 2010 voters. July 7-14, 2009. Margin of error: ±2.25 percentage points.

[xiv] Gallup Poll. 1,020 adults nationwide. April 8-11, 2010. Margin of error: ±4 percentage points.